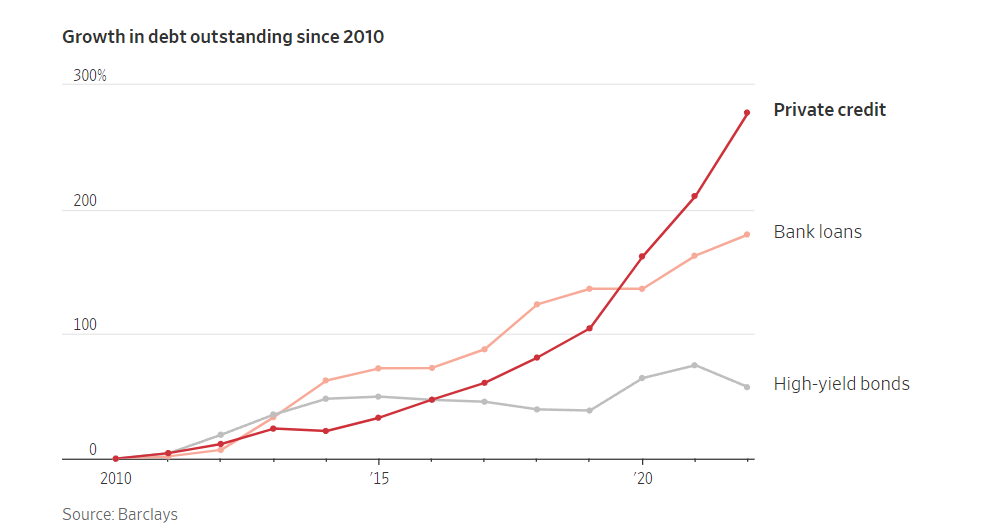

Private credit funds are taking over the corporate lending market, with assets under management rising to $1.5 trillion in 2022 from $726 billion in 2018. This shift is being driven by a number of factors, including high-interest rates, which are making it more difficult for companies to borrow from banks.

These private credit funds are able to offer large loans, and they are not required to get credit ratings from borrowers. They also guarantee completion of loans, even if market conditions change. However, private credit loans typically have tougher covenants than bank loans, and they charge higher interest rates.

Some analysts are concerned about the growing role of private credit funds in the corporate lending market, arguing that it could concentrate risk in the hands of a few large asset managers. However, others believe that private credit funds can provide a valuable source of capital for companies and offer investors better returns than bank loans.